AR tools for industrial maintenance

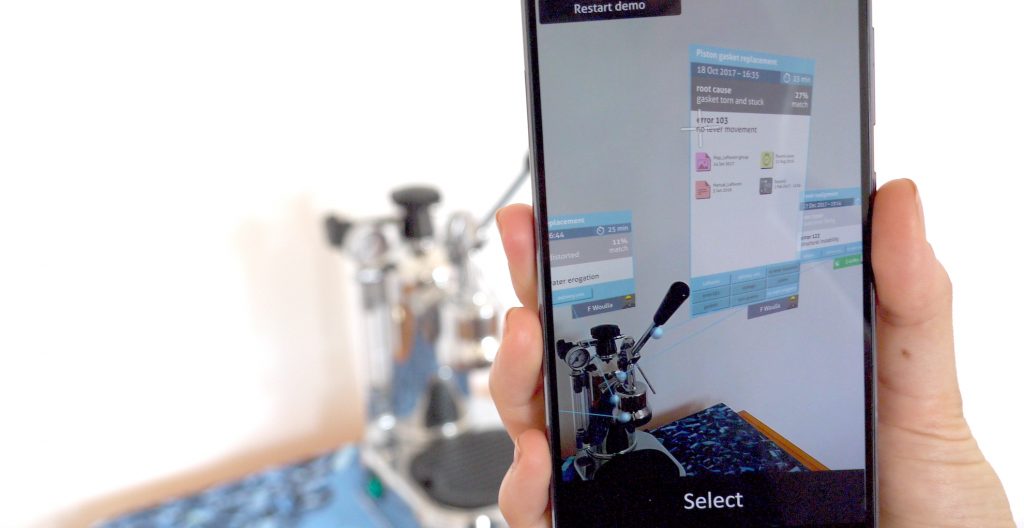

AR tools for industrial maintenance Hitachi Share Experientia created digital AR tools that added intelligence and efficiency to the industrial maintenance and repair processes in the shopfloor’s context. A working hi-fi AR prototype was demonstrated to the C-suite. Based on the as-is maintenance process and existing pain points, Experientia conceptualized use-case scenarios, interaction flows and interfaces. 3 things to know Express delivery Our benchmark focused extensively on Europe, US, China and Japan while industry experts joined our research from 5 different countries, bringing insights from all around the world. Focus on core issues Through user journey mapping, main issues of industrial maintenance were uncovered and turned to key solutions for the interaction concept. Innovation throughout Cutting edge technology platforms like AR Core and Google’s Cloud Speech API were used to create a coherent system between mobile, smartwatch and earbuds. Gallery Multilayer tech ecosystem that combines three devices: smartphone, smartwatch and headphones Watch interface Watch interface Analysis diagram of the maintenance process and existing pain points In depth Service mix: Prototyping Information architecture Service design Behavioral modeling Context The client is an industrial player that has its own factories and also provides shop floor equipment to factories of their clients. In these environments any interruption in an assembly or production line is very costly. Challenge Efficient production time is lost due to misinformed, miscommunicated and non-standardized maintenance processes. The solution is a combination of user and system generated content that constantly improves according to daily incoming data about maintenance operations. The client would like to use AI and machine learning to provide values for all the stakeholders. Research Focused on worker’s needs to get jobs done rather than just spreading technologies, our solution was built on day-to-day tech providing maintainers with non-invasive support enabling them to be able to choose the best tech and device depending on the context and their personal experience. We used a (high end) coffee machine as a simulacrum of an industrial machine and mapped user journey and defined opportunities of digital tools for industrial maintenance. Design The proposed solution is a multilayer tech ecosystem that combines three devices: smartphone, smartwatch and headphones. They overlay timely, qualitative and statistical information to maintainers about assets, manuals and maintenance steps. The solution enables communication amongst colleagues and creates an easy reporting system, all integrated through a user and system generated database. Experientia designed a hi-fi prototype to showcase functionality and adequacy of an augmented multistep maintenance process on an exemplary machine. The prototype consists of an augmented reality app on mobile, an information app on a smartwatch and voice assistant interaction on a bluetooth headset. The demo across three devices proved interaction patterns and its benefits. The user journey consists of the six steps of a general maintenance process (asset failure, location, inspection, repair, spare parts, report and shift handover) organized along with macro phases (inspection, operation, communication, documentation). As second layer, we considered elements such as actors / tools and challenges and we highlighted the time consuming activities. Impact The client used the demo internally as a proof of concept to obtain further funding for future exploration As next steps the knowledge platform needs to be implemented and the solution should be tested on a shopfloor.. Related projects All Services Behavioral design Research and assessment Strategy B2B Collaboration UI, redesigning the filter navigation experience B2B Reinventing customer and supplier interactions for a multinational flooring company B2B Driving digital transformation one touch at a time Go back to our portfolio

Exploring urban dwelling usage to inform appliance design

Exploring urban dwelling usage to inform appliance design Samsung Share As the urban population (>75%) is supposed to continue its growth, dwellings demand will follow along. The client requested an analysis of Europe’s housing market, its recent past and emerging trends. Focusing on millennials, the generation approaching the property market, we investigated emerging drivers for both dwelling and major household appliances. 3 things to know Dwelling space is increasingly a premium In the three cities, singles/couples look for 55-65 sq m apartments; families are more focused on 70-80 sq m. It is also common for single people to live in studio apartments (about 30 sq m), especially in Milan and Stockholm. House minimum set-up Tenants in Berlin and Milan usually find, in the dwellings they rent, some basic pieces of furniture (table, chairs, beds) besides a functioning kitchen complete with cabinets. Appliances are transient When renting, people have a temporary attitude towards appliances and they tend to buy either less expensive (to leave-in when relocating), small (e.g. toaster, kitchen robot), or portable ones (e.g. free standing fridges). Gallery In depth Service mix: Business strategy design Behavioral modeling Ethnography Context We supported a client in mapping European changes in residential space, identifying population structures in urbanized areas, while highlighting areas where millennials aspire to live. The research predicts changes in the layout and setup of urban abodes and derives opportunities for base-line vs luxury appliance configurations. Challenge We investigated the EU property market and the demographics of Germany, Italy and Sweden to define the target sample fitting the research brief. The ensuing fieldwork aimed at involving realtors, interior architects and millennial owners and tenants in Berlin, Milan and Stockholm. Research We conducted an extensive fieldwork across Europe, touching 3 cities. Contextual interviews and dwelling observations involved 7 realtors, 19 residents and 3 local experts. The visits in millennial homes exposed the research team to the attitude, lifestyle and purchase drivers of this new generation of tenants and owners. Design The analysis of the extensive body of evidence collected resulted in insights about key drivers influencing millennials’ purchase of dwellings as well as home appliances. Participant profiling guided the team in identifying opportunities for home appliance brands that aim at addressing the expectations of millennial customers. Impact The research helped shed light on initial assumptions, discovering evidences for decoupling prime properties and luxury consumer products: people expect kitchen appliances to come in “kits” linked to kitchens. Customers expect to refer to kitchen suppliers for all issues pertaining kitchen components. As cooking habits change and fresh food consumption increases, people tend to forgo appliances that are culturally connected to long-term food preservation. Open floor plans entail kitchens, and the appliances therein are always on the front-stage. When use scenario switches to full entertainment or living, appliances should be able to blend with the rest of the interior. Related projects All Services Behavioral design Research and assessment Strategy Consumer technology Buttonless: engaging users in interactions with keyless devices Consumer technologyFinance BancoSmart, an award-winning ATM Consumer technology Finding entertainment on the go Go back to our portfolio

European car aesthetics: Unveiling preferences and values

European car aesthetics: Unveiling preferences and values Client confidential Share In a moment of transition in technology and in the use of cars, new players appear on markets with established automotive manufacturers to offer innovative solutions. But how can you understand habits, preferences and values of new customers in order to make your new solutions more attractive? An Asian automotive company asked Experientia to explore the aesthetic tastes and mobility habits of European consumers developing evidence-based market segmentation. 3 things to know Quali-quantitative study By combining these two approaches, researchers could first explore and statistically validate the aesthetic preferences and trends through a large quantitative analysis, and then gain a deeper and more detailed understanding via a focused qualitative investigation. Personas, scenarios and VLOGs Quantitative survey and qualitative interviews categorized insights by assessing participants across dimensions like aesthetic taste, innovation openness, and choice drivers resulting in 12 personas. These personas were then linked to different scenarios, enabling a deeper exploration of individual attitudes and complexities. Additionally, 4 participants create 10-minute videos showcasing city life and aesthetics of 4 European cities, providing an intimate perspective on local culture and preferences. Large scale investigation The first part of the study was conducted on a large sample of participants across 10 European countries, while the second part involved a more detailed investigation in 4 of these countries conducted by local researchers. All the investigations were carried in the native language of each country. Gallery Car scenarios Car Persona – The sporty luxury lover Car 12 Personas Car aesthetic preferences Car Personas – love nest In depth Service mix: Design thinking Service design Ethnography Useful links: Link External link Context A major Chinese auto manufacturer was looking to expand its presence in the European market. To achieve this, they have commissioned Experientia to conduct a comprehensive study that focuses on exploring evolving preferences and environmental influences that shape the future lifestyle and aesthetic trends of mature automobiles among Europeans. Challenge The objective was to achieve a comprehensive understanding of potential European customers, exploring differences rooted in demographics as encompassing cultural backgrounds and personal aesthetic values. Research The first project phase included a quantitative survey, conducted with 300 individuals each in 10 European countries The second phase comprised qualitative research involving 20 interviews with five participants from four countries, conducted in the local language and complemented with city tours to deepen understanding of local culture and environments. The survey and interviews explored users’ aesthetic preferences and daily experiences. Design The gathered data enabled valuable modeling for product design, resulting in 12 personas defined by aesthetic preferences for cars and everyday items, as well as by lifestyle, demographics, mobility and purchase habits. Six scenarios highlighted each personas’ motivations and concerns about cars, while four vlogs portrayed mobility experiences of vloggers in four cities. These vlogs served to provide an aesthetic representation of diverse neighborhoods within four European cities. The intention was to offer aesthetic evidence of the urban environments, with the specific purpose of informing the design of products that will be tailored for these markets. Impact The results will be the base to improve product offerings, and enhance marketing strategies. Link External link Related projects All Services Behavioral design Research and assessment Strategy Consumer technology Buttonless: engaging users in interactions with keyless devices Consumer technology Mobile Privacy UX Consumer technology Customer experience insights to innovation Go back to our portfolio

Retail user experience for sustainable energy service

Retail user experience for sustainable energy service Client confidential Share Understand rising customer expectations of energy providers to deliver innovative, personalized and omnichannel customer experiences for an energy company with a focus on renewable energy. 3 things to know Understand the energy market Experientia interviewed energy experts and users with different levels of experience. This allowed us to understand people’s habits, sources of information, and the online platforms currently most used. The emphasis was on sustainable and environmental developments and technologies. Identify opportunities Participatory activities with users and client allowed us to identify opportunities and outline three concepts, all considered for further development. Each of the concepts will result in a digital touchpoint for users to inform better customer decisions in the energy market by sharing tips and suggestions in matters of sustainability and energy usage. Involve users in energy saving on the local level Experientia conducted a comprehensive communication analysis to highlight the need for a coherent and defined communication strategy, with a focus on environmental and sustainable energy aspects, in order to enable a greater focus on customer-centered energy services. Gallery Energie Report In depth Service mix: Design thinking Participatory design Service design Ethnography Useful links: Link External link Context A renewable energy company wants to expand its market towards retail customers, strengthening its presence on the Italian market in a context of continuous change in the energy sector. Challenge Facing growing environmental awareness, the client aimed to better understand the retail user experience to design an attractive, updated service offering and asked Experientia for support in this challenge. Research Experientia conducted desk research on competitors’ energy services, analyzed relevant case studies and interviewed energy experts (including individuals ranging from architects, urban experts, and similar professionals) in order to shape an extensive trend research and identified strategic market opportunities for the client. These experts were carefully selected to bring diverse perspectives and insights into our research efforts. The Experientia team also conducted qualitative user interviews in order to understand (potential) customer behaviors and their gain/pain points to map and evaluate the user experience. The in-depth interviews allowed us to investigate the research question from a wide, comprehensive perspective. Model and Design Experientia utilized findings from the research to frame and define opportunities. The team conducted participatory activities to outline new design concepts. Through sharing sessions and participatory activities we validated and prioritized the opportunities emerged from the research, to develop ad hoc solutions for the client and its targeted users. In parallel, the entire research activity involved also analyzing company’s communication to identify weaknesses and opportunities to build a consistent communication strategy. Impact The results of the project allow to shape 3 main concepts linked to potential solutions to be implemented in the following phase. The team identified standard services, energy market touch-points, ideas, and best practices that inspired the design phase, working alongside with project key stakeholders to brainstorm and develop potential solutions to attract new retail customers. After thorough evaluation and consideration, the client team selected these concepts to be developed in a second of the project, now ongoing. This strategic decision demonstrates our client’s commitment to implementing innovative solutions and underscores the value of our collaborative approach in shaping the project’s future direction. Link External link Related projects All Services Behavioral design Research and assessment Strategy Brand UXConsumer technology European car aesthetics: Unveiling preferences and values Brand UXConsumer technology Mobile Privacy UX Brand UX Qualitative research on food and drink consumption to develop new consumer services Go back to our portfolio